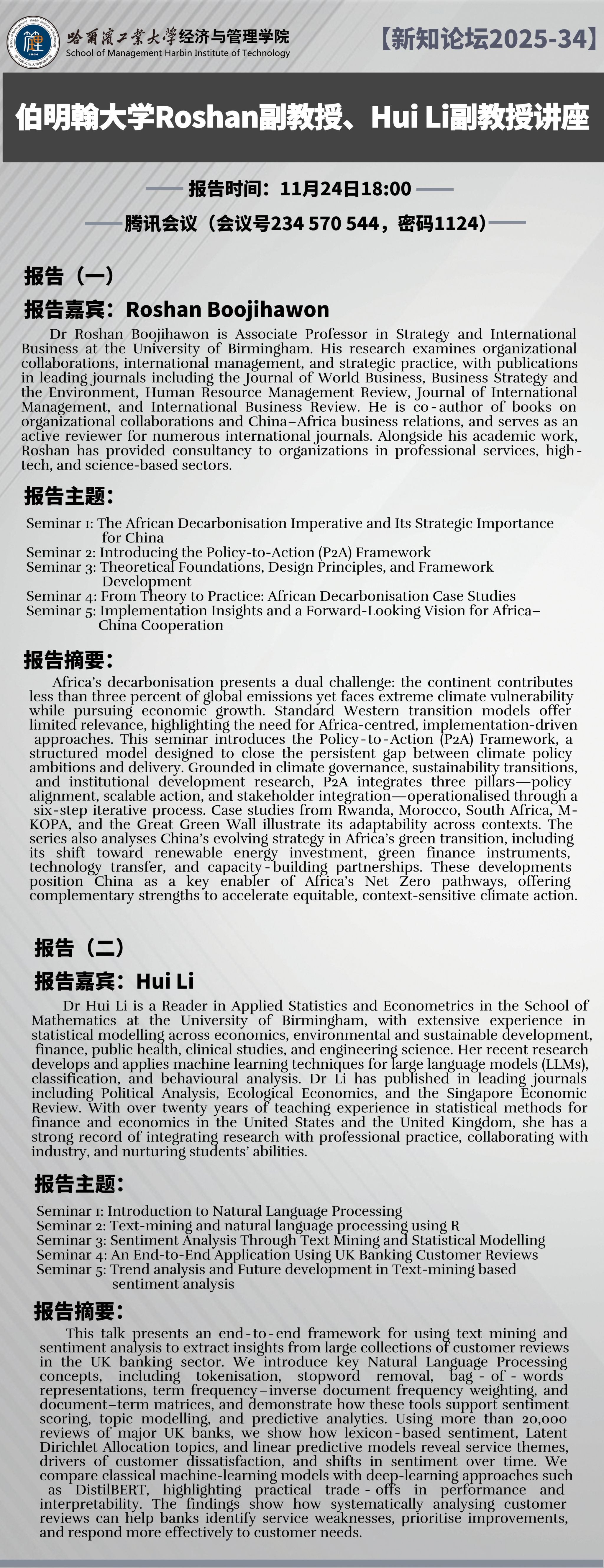

报告时间:11月24日18:00

报告地点:腾讯会议(会议号234 570 544,密码1124)

报告(一)

报告嘉宾:Roshan Boojihawon

Dr Roshan Boojihawon is Associate Professor in Strategy and International Business at the University of Birmingham. His research examines organizational collaborations, international management, and strategic practice, with publications in leading journals including the Journal of World Business, Business Strategy and the Environment, Human Resource Management Review, Journal of International Management, and International Business Review. He is co-author of books on organizational collaborations and China–Africa business relations, and serves as an active reviewer for numerous international journals. Alongside his academic work, Roshan has provided consultancy to organizations in professional services, high-tech, and science-based sectors.

报告主题:

Seminar 1: The African Decarbonisation Imperative and Its Strategic Importance for China

Seminar 2: Introducing the Policy-to-Action (P2A) Framework

Seminar 3: Theoretical Foundations, Design Principles, and Framework Development

Seminar 4: From Theory to Practice: African Decarbonisation Case Studies

Seminar 5: Implementation Insights and a Forward-Looking Vision for Africa–China Cooperation

报告摘要:

Africa’s decarbonisation presents a dual challenge: the continent contributes less than three percent of global emissions yet faces extreme climate vulnerability while pursuing economic growth. Standard Western transition models offer limited relevance, highlighting the need for Africa-centred, implementation-driven approaches. This seminar introduces the Policy-to-Action (P2A) Framework, a structured model designed to close the persistent gap between climate policy ambitions and delivery. Grounded in climate governance, sustainability transitions, and institutional development research, P2A integrates three pillars—policy alignment, scalable action, and stakeholder integration—operationalised through a six-step iterative process. Case studies from Rwanda, Morocco, South Africa, M-KOPA, and the Great Green Wall illustrate its adaptability across contexts. The series also analyses China’s evolving strategy in Africa’s green transition, including its shift toward renewable energy investment, green finance instruments, technology transfer, and capacity-building partnerships. These developments position China as a key enabler of Africa’s Net Zero pathways, offering complementary strengths to accelerate equitable, context-sensitive climate action.

报告(二)

报告嘉宾:Hui Li

Dr Hui Li is a Reader in Applied Statistics and Econometrics in the School of Mathematics at the University of Birmingham, with extensive experience in statistical modelling across economics, environmental and sustainable development, finance, public health, clinical studies, and engineering science. Her recent research develops and applies machine learning techniques for large language models (LLMs), classification, and behavioural analysis. Dr Li has published in leading journals including Political Analysis, Ecological Economics, and the Singapore Economic Review. With over twenty years of teaching experience in statistical methods for finance and economics in the United States and the United Kingdom, she has a strong record of integrating research with professional practice, collaborating with industry, and nurturing students’ abilities.

报告主题:

Seminar 1: Introduction to Natural Language Processing

Seminar 2: Text-mining and natural language processing using R

Seminar 3: Sentiment Analysis Through Text Mining and Statistical Modelling

Seminar 4: An End-to-End Application Using UK Banking Customer Reviews

Seminar 5: Trend analysis and Future development in Text-mining based sentiment analysis

报告摘要

This talk presents an end-to-end framework for using text mining and sentiment analysis to extract insights from large collections of customer reviews in the UK banking sector. We introduce key Natural Language Processing concepts, including tokenisation, stopword removal, bag-of-words representations, term frequency–inverse document frequency weighting, and document–term matrices, and demonstrate how these tools support sentiment scoring, topic modelling, and predictive analytics. Using more than 20,000 reviews of major UK banks, we show how lexicon-based sentiment, Latent Dirichlet Allocation topics, and linear predictive models reveal service themes, drivers of customer dissatisfaction, and shifts in sentiment over time. We compare classical machine-learning models with deep-learning approaches such as DistilBERT, highlighting practical trade-offs in performance and interpretability. The findings show how systematically analysing customer reviews can help banks identify service weaknesses, prioritise improvements, and respond more effectively to customer needs.